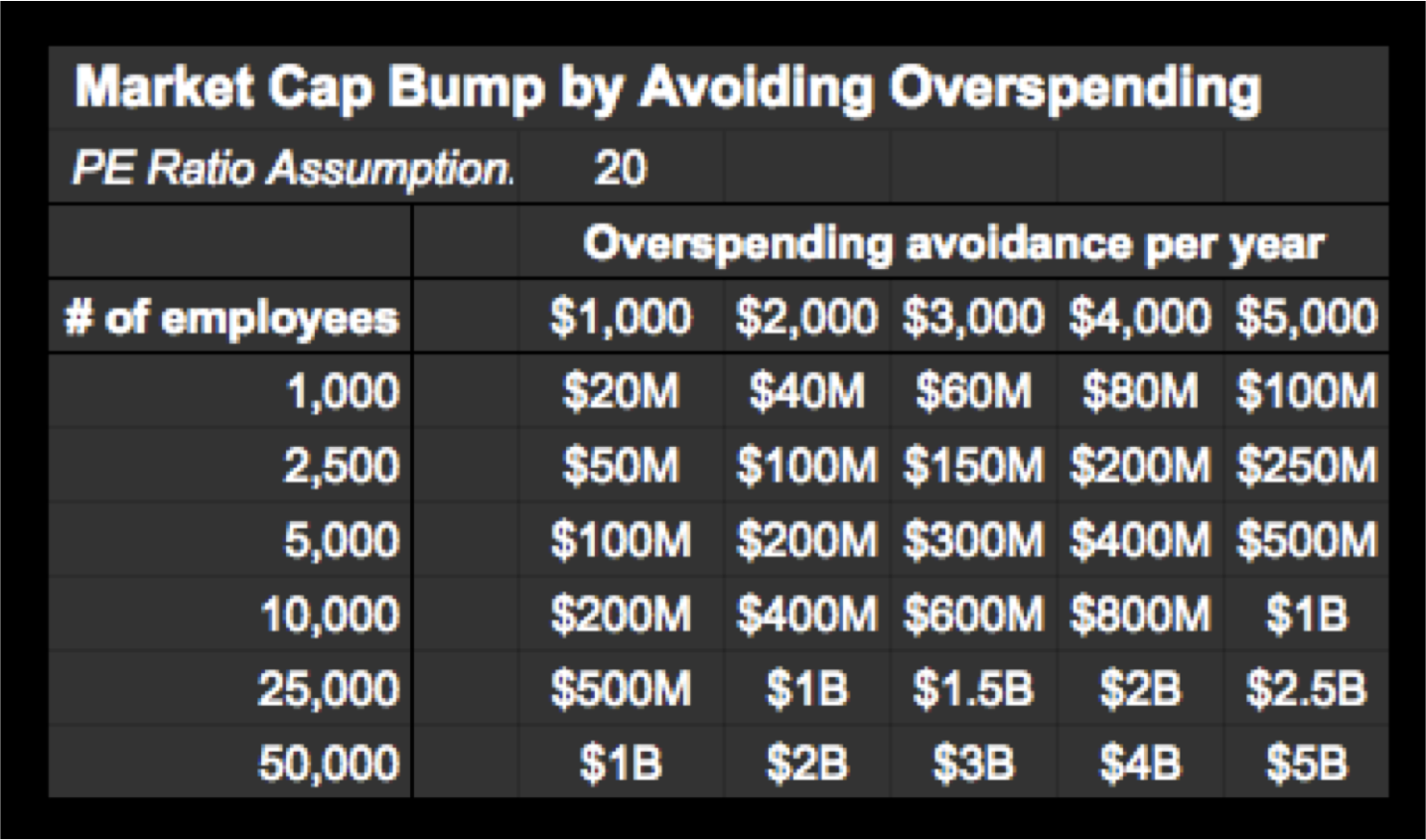

My keynote presentation to leaders from most of the largest financial firms on Wall Street got me thinking about the shareholder value being held back by ineffective healthcare purchasing -- the second largest cost after wages for most organizations. Previously, I highlighted the tricks the healthcare industry uses to redistribute profits from companies to their coffers. In this piece, I will outline the antidotes that the most effective benefits leaders use to ensure their organizations maximize shareholder value by avoiding needless overspending on health benefits. As the earlier article pointed out and the table below illustrates, this can have a major impact on shareholder value.

As I've been working as a subject matter expert on The Big Heist film (think of it as The Big Short for healthcare), my talk to Wall Street leaders on how there are opportunities hiding in plain sight seemed apropos. A well-regarded author and business consultant, Ric Merrifield, has also provided advice to the film and had the following to say:

“The Big Short, and Moneyball, had one major theme in common - in the face of a mountain of evidence, the evidence was ignored - in the case of baseball for over 20 years until someone got backed into a financial corner and had to take a big chance. Baseball kept ignoring the value of OBP relative to batting averages, stolen bases, and RBI. Wall Street and regulators didn’t downgrade the credit ratings of the mortgage backed securities even when the mountain of evidence was presented to them. So why should we expect healthcare to be any different? Healthcare is in the same place at the moment. The healthcare mess in many ways is happening in broad daylight and there is no evidence of major change.”

Translating overspending avoidance into market cap impact

The habits outlined below are drawn from some of the most innovative benefits consultants in the country such David Contorno, Jim Millaway and Keith Robertson. In addition, the “Dream Team” of benefits experts I highlighted earlier also contributed. Greater details exist for many of these items in the Health Rosetta components where a LEED-like certification is being worked on to guide the future of health and wellness purchasing. If you are creating solutions for healthcare purchasers, you will find that the guiding principles Leonard Kish and I curated from many of the industry’s leading thinkers will also be very useful.

Collectively, the approaches outlined below have enabled employers to save 20-55% less per capita on health benefits versus a standard employer approach. One manufacturer increased their earnings by 1.7% by getting a fraction of their employees onto just one of the "habits" outlined below. With millions being wasted in healthcare, it's not hard to imagine activist shareholders and private equity firms realizing there is way to turn healthcare's historic excess into shareholder value. Cost savings compound over the years. While too many employers accept annual premium increases of 10% or more, wise employers are converting overspending on healthcare into delivering better value to their stakeholders, whether they are employees, union members, citizens or shareholders.

Beyond activist shareholders, there is also an emerging cohort of activist attorneys who see that a large swath of employers operating under the ERISA regulatory framework who are failing in their fiduciary duties. While there is tremendous rigor applied to the fiduciary duty for 401-k's, there is nothing of that sort in most employers. The legal duties are the same for healthcare than they are for retirement benefits. What's worse is most companies are spending at least twice on health benefits than they are retirement. As CFOs and HR executives are targeted for breach of fiduciary duty, it has been a tremendous wake-up call for companies to expect far more from their benefits consultants and wellness programs with dubious ROI claims.

[Disclosure: The Health Rosetta is an open-source project that provides a reference model for how purchasers of healthcare should procure health services. In my role as managing partner of the Hf Quad Aim Fund, a seed-stage venture fund, the Health Rosetta is the foundation of our investment thesis.]

Habit #1: First things first: Value-based primary is the bedrock of the highest-functioning health systems

Value-based primary care stands in stark contrast to the milk-in-the-back-of-the-store primary care model that has been a pervasive driver of the scourge of overtreatment. Grassroots change at the city level is recognizing the importance of primary care and how it can attract major employers. IBM is a leading example of how wise organizations recognize that health benefits are the second biggest cost input into their business. Like any other item in their supply chain, they will shift to high-value suppliers. It turns out that locating jobs in high-value healthcare communities boils down to those communities with the strongest foundation of valued-based primary care.

A short subway ride away, one of the value-based primary care leaders is demonstrating how affordable proper primary care can be. Low-income workers are paying $10 per week out of their own pocket for primary care that is superior to what 99% of the population receives -- rich or poor.

The two best examples of value-based primary care are onsite/nearsite clinics and direct primary care. Primary care can generate its own savings due to avoiding rationing choices (resulting in 30%+ in unnecessary surgeries, specialist referrals, etc.), but it is also foundational for the other habits. Note: Less than half of onsite/nearsite clinic providers have a modern care delivery model that has a proven ROI. I advise employers to work with an onsite clinic advisor in selecting and managing high-performance vendors if you don’t have the time or expertise. Contact me if you want a pointer to a good resource.

Habit #2: Be proactive managing pharmacy benefits

Successful Rx management has been described as playing whack-a-mole. The pharmacy benefits management (PBM) industry has many firms that are well known for hidden fees, shell game pricing and taking drug manufacturers’ money to promote specific drugs.

There are three pillars to manage drug cost and quality:

- Review PBM arrangements to determine the "spread" (PBM profit) and whether more favorable terms are available.

- Formulary changes that create a large financial impact with next to no disruption.

- Carefully manage specialty drug acquisition and use.

Habit #3: Have specific plans for uncommon, but predictable, gargantuan claims

While these claims are uncommon, they are so extraordinarily high, there must be a defined program for each. It’s not uncommon for 6% of employees to account for 80% of annual claim costs and they usually fall into the following areas:

- Dialysis: With the rise of diabetes, this is an inevitability. The best dialysis cost containment vendors offer multiple solutions aimed at getting the best price before treatment starts and they provide the most flexibility in choosing approaches that are appropriate to a specific situation.

- Organ transplants & complex surgery: Using a Centers of Excellence program has resulted in eliminating unnecessary complications and procedures by sending beneficiaries to outstanding centers such as the Mayo Clinic, Virginia Mason and other high-performance centers.

- Preemie babies: Rosen Hotels is a great example of how a great program can ensure the well-being of the baby and the mother. Even though 56% of Rosen’s pregnancies are classified as high-risk, they have a program in place that ensures the well-being of the mother and baby as well as the company’s bottom line (Rosen spends 55% less per capita on overall health benefits with an outstanding health benefits program).

Habit #4: Deploy evidence-based musculoskeletal management programs, avoiding rampant overtreatment

With musculoskeletal (MSK) issues frequently accounting for 20% of claim costs and over 50% of the treatments being inflicted on employees not being evidence-based, there is a tremendous opportunity for improvement. One manufacturer increased their earnings by 1.7% by getting just a third of their MSK cases managed in an evidence-based program. The impact on the company’s market cap was tens of millions.

Evidence-based approaches capitalize on clinical knowledge with modern quality management techniques and big data. The results, validated in many settings, demonstrate far superior health outcomes.

Habit #5: Refuse to sign blank checks the to healthcare industry

There is no reason to sign a blank check to the healthcare industry, which is the de facto approach too many employers have come to accept. As I assembled a Dream Team of benefits experts for the solution to United Technologies' plan for shipping jobs to Mexico, they made it clear that virtually every area of healthcare has high-integrity and high-quality providers that welcome price transparency. Bundled procedures are an important tip-of-the-iceberg example, but it goes far beyond that. True price transparency has solved the most vexing problem in healthcare—pricing failure. So-called "transparency tools" that simply highlight the best bad deal and still inflict a horrible consumer experience have proven they don't get the job done.

Habit #6: Think win-win. Reward employees by sending them to high-quality providers who should also be rewarded for safety transparency

Johns Hopkins surgeon Dr. Marty Makary pointed out in devastating detail in his Unaccountable book how flawed the safety culture is in far, far too many hospitals. No business would accept half of the inputs from a supplier adding no value, which is the norm in healthcare. Nor would a corporate travel department allow an employee to fly on an airline if it suppressed their safety records (even if the FAA allowed this). Yet, every day, employers put beneficiaries in harm’s way by allowing them to use providers suppressing safety deficiencies. It’s unconscionable to blindly go into hospitals with little or no information on their safety culture despite it being available to the hospital itself. Makary lays out in "How to Stop Hospitals From Killing Us" how forward-looking hospitals are transparent about their safety records and culture. Naturally, any hospital proud of its safety record shouts it to the hills. What does it say about a hospital that suppresses safety scores and intensely lobbies to hide this information from the public? By extension, what does it say about an employer willing to send unwitting employees into a hospital that is suppressing safety scores?

Habit #7: Sharpen the saw: Avoid reckless plan document language costing millions

As mundane as ERISA plan language can sound, the most effective benefits leaders ensure there is good plan hygiene. It’s such an important topic, there is a section of the Health Rosetta dedicated to sample plan document language. The previous habits and other items must be properly documented or an employer lacks important recourse. One of the most important items helps avoid what has happened to HR executives at the GAP where they were named in a lawsuit—something that could have been easily avoided with the following example of good ERISA plan practices :

Outsourcing fiduciary duties for final-level internal appeals is the most efficient and cost-effective way of handling this responsibility. For this reason, leading ERISA firms provider approach that shifts the fiduciary burden of handling final-level appeals onto a neutral third-party, which assumes the risk for the determination.

Fortunately, there are high-quality providers across the range of healthcare areas. As one puts it, they strive to deliver “twice the healthcare, at half the price and 10 times the delight.” Forward-looking benefits leaders are proving that the best way to slash healthcare costs is to improve benefits.

This article was also published in Forbes

Subscribe to The Future Health Ecosystem Today or follow on Twitter

Contact via Healthfundr for expertise requests or speaking engagements

Upcoming travel/speaking schedule present opportunities to get on Dave's speaking calendar:

- Week of July 4: Toronto

- Week of July 25: Montana

- Week of September 8: Pittsburgh

- Week of September 19: Northern Europe

- Week of October 24: New York

- Week of November 14: Chicago